Giving From Your Donor-Advised Fund

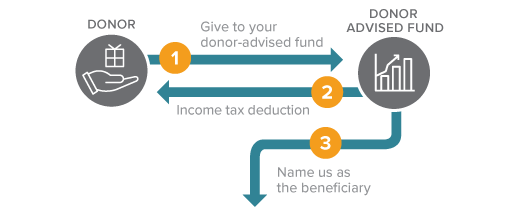

Make an outright gift from your donor-advised fund OR name us as the ultimate beneficiary of the remainder in the fund.

How It Works

- Name Indian River State College Foundation as a beneficiary of your donor-advised fund (DAF).

- Designate us to receive all or a portion of the balance of your fund on your passing.

- The balance in your fund passes to Indian River State College Foundation when the fund terminates.

- During your lifetime you can also make grants to Indian River State College Foundation from your donor-advised fund. See how a DAF works.

Benefits

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Maintain flexibility to change beneficiaries if your needs change during your lifetime.

- You can also direct your DAF to other charitable causes.

Next

- More detail on Donor-Advised Funds.

- Frequently asked questions on Donor-Advised Funds.

- Contact us so we can assist you through every step.